50 years back, owning Cryptocurrency was just a dream or rather a fantasy of tech enthusiasts. And today, every tom, dick, and harry own a cryptocurrency. But what is digital currency? Let’s know about it.

Cryptocurrency is a digital ledger or tender which can be used to buy stuff in a similar way to fiat money. The word cryptocurrency was derived from the encryption methods used to secure the transactions occurring in the network. This currency is issued digitally to the public, secured by cryptography, and decentralized by the technology of Blockchain. The major interest of the investment community is because of its skyrocketing prices, and its ability to beat inflation by a huge margin. For example, the price of Bitcoin aka the digital gold of the crypto-market has increased by more than 30 million times since its first issue in the year 2009. Bitcoin was the first cryptocurrency issued in the market by an anonymous man named Satoshi Nakamoto. As of July 10, 2021, the market cap of these virtual currencies was around $1.3 trillion down from its an all-time high of $2.2 trillion.

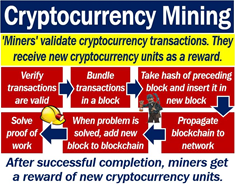

These digital tokens are minted by professional coders after solving complex mathematical problems with the help of coding. After each successful problem solving, the miner receives some amount of cryptocurrency which varies from currency to currency. As of today, there are more than 10,000 cryptocurrencies and Indian investors own around 10% of the total floated number of crypto in the market. These currencies are not issued by any central authority which makes them not lose value via inflation. They use a decentralized structure to keep the government authorities away from the control of the flow of money. The advantage of these over the regular money is that they allow users to do transactions round the clock, unlike the banks which have a fixed time. The fee per transaction is low when it comes to transferring large sums of money. Also, they help the users to keep their privacy intact while transferring money. Moreover, through this, we can transfer money all over the world.

The disadvantages of cryptocurrencies have roots in their advantages. The privacy-focused feature of them makes it a host for all sorts of illegal activities including sponsoring of terrorist activities, tax evasions, etc. The autonomous feature of price and valuation makes them soar sky-high in few tweets and crack by 10% in single negative news about them. This makes them a very risky investment in the long term. El Salvador in June 2021 became the first country to accept Bitcoin as a legal tender.

The legality of cryptocurrency varies from country to country. Some countries have allowed them for trade and others have banned their possession. Various agencies have regularly investigated Bitcoin scams and their roles in various international-level crimes. The Chinese government has recently cracked down on various crypto mining companies. Many central banks have announced to bring their own digital currencies. The majority of online social media platforms have a self-imposed ban on cryptocurrency ads. In India, currently, no such ban on the trade of cryptos exists but the same is on the cards of the Ministry of Finance. Also, no special tax exists on gains through the trading of virtual currencies by the IT department.

As of today, there are many crypto-exchanges presents through which you can trade with ease just like stocks. In India, exchanges like WazirX, CoinDCX, CoinSwitch Kuber have been in this business for a long time and providing Indians to trade cryptos. Though these wallets which store crypto are highly secure in the past there have been several cases of theft and fraud in the market, making the investors rethink their choices. Despite all these threats, the amount of money invested in these coins has regularly increased.

Also, Read- What is off-page SEO?